How far is Cyrus, who is hugging Huawei’s thigh, far ahead? | Titanium Investment Research

Since its listing on September 12th, the M7 has been continuously concerned by the market, with orders reaching 15,000 vehicles on the first day of listing and more than 20,000 vehicles within five days of listing. The popularity of orders has caused the stock price to rise sharply recently. From September 14th to 18th, the company’s stock price achieved two boards in three days.

In fact, with the help of Huawei’s auto concept stocks, the company’s share price began to rise after the release of Huawei’s new machine. Since the release of Huawei’s new machine on August 29, the cumulative increase of the company’s share price has reached 56.02%, much higher than the 6.5% increase of the auto sector in the same period. In view of the recent large increase in the share price, the company issued an announcement on the evening of September 18 to remind investors to invest rationally.

However, in contrast to the company’s higher share price, the company has continued to lose money in recent years, and its profitability is not optimistic. In the first half of 2023, the company deducted 1.885 billion yuan from its net profit, down 9.96% year-on-year.

Celestial was originally a brand of Jin Kang New Energy, a new energy subsidiary of Xiaokang, and was renamed Celestial Automobile Co., Ltd. in May 2022, and then the abbreviation of Xiaokang Securities was changed to Celestial in August.

Xiaokang shares are well known to the outside world, mainly relying on mini-vans. In the early days, the company started with the production of springs, and then its business expanded to auto parts. In 2003, the company cooperated with Dongfeng and began to enter the field of automobile production. The main model was Dongfeng Xiaokang van. In 2012, the sales volume of mini-cars exceeded 1 million, and it was once called the three giants of China mini-cars with Wuling Hongguang and Changan Star.

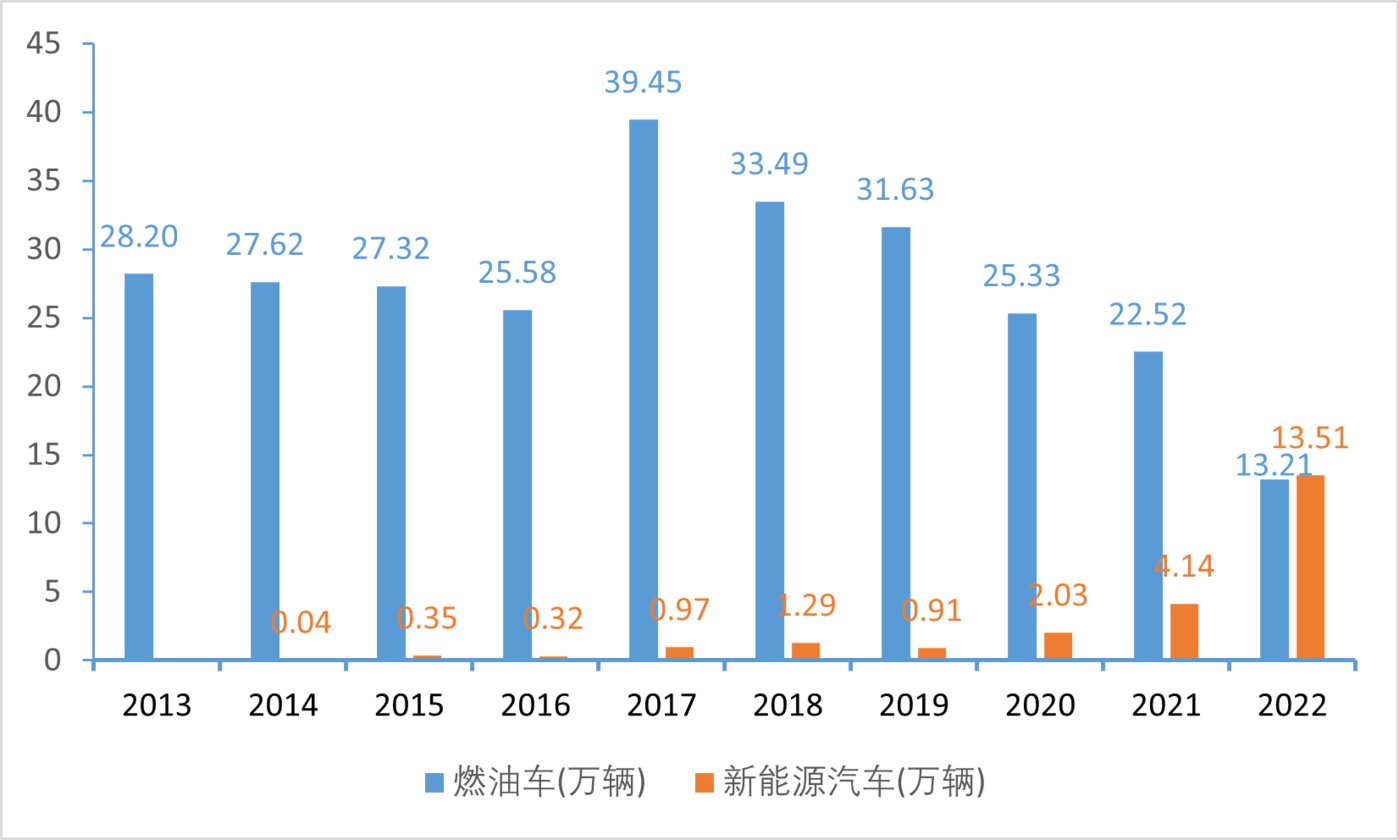

From 2013 to 2016, the company’s fuel vehicle sales showed a slight decline as a whole. In 2017, with the substantial increase in SUV sales, the company’s fuel vehicle sales reached a high point, and then began to decline year by year, from 394,500 in 2017 to 225,200 in 2021, and the fuel vehicle sales in 2022 dropped sharply to 132,100.

The decline of fuel vehicle business made the company begin to shift its focus to new energy vehicles, but the road to transformation was not smooth. In July 2020, the annual sales volume of Celeste SF5 was only 732 vehicles, which was not accepted by the market.

In March, 2021, the company announced that it had reached a cooperative relationship with Huawei. Celestial Huawei Smart Select SF5 was equipped with Huawei electric drive and HiCar system. Through cooperation with Huawei, the sales volume of Celestial SF5 also increased significantly. From April to December, 2021, the cumulative sales volume of Celestial SF5 exceeded 8,500, and the company’s annual sales volume of new energy vehicles reached 41,400, up by 103.94% year-on-year.

The success of the cooperation with Huawei has also enabled the company to further bind Huawei. In December 2021, the company and Huawei jointly launched the AITO Jiejie brand. Huawei has deep participation in industrial design, quality control, intelligent cockpit and automatic driving, and is also responsible for Jiejie marketing and channels.

Thanks to Huawei’s all-round blessing, in 2022, the sales volume of M5 and M7 reached 75,000, becoming the fastest-growing brand of new energy vehicles. The annual sales volume of Celeste new energy vehicles also reached 135,100, up 226.33% year-on-year, and the sales volume exceeded that of fuel vehicles.

In addition, through the cooperation with Huawei, the company’s share price has tripled in just a few months. When the company reached a cooperative relationship with Huawei in March 2021, the company’s share price was around 20 yuan, and by the end of June 2021, the share price was close to 80 yuan, with an increase of 300%.

Although relying on Huawei’s brand influence and technical strength, the sales of Celestial new energy vehicles have been greatly improved in a short period of time, but Huawei’s dominant position in the world brand has also made Celestial rely heavily on Huawei and lose more decision-making power. Traditional car companies such as Guangzhou Automobile refused to cooperate with Huawei in depth, and the main reason for using Huawei as a component manufacturer was that it was worried that it would lose its independent decision-making power.

On the other hand, apart from cooperating with Cyrus, Huawei is also cooperating with Chery, BAIC and other manufacturers, which will inevitably dilute the influence of Huawei brands on Cyrus. For example, the intelligent world S7, which Huawei cooperates with Chery, will first be equipped with the HarmonyOS 4.0 car system, which is earlier than the M9.

In fact, Celestial is also laying out its own independent brand of new energy vehicles. In March 2023, the company launched its own brand of Blue Power, and in the same month, it released its first model, Blue Power E5. In addition to Huawei HiCar system, BYD hybrid system was adopted as the core three power technologies, but only 1,944 vehicles were sold by the end of August, and the market performance was bleak.

About the complete content analysis of the article, it can be upgraded to titanium media PRO users to read the full text.