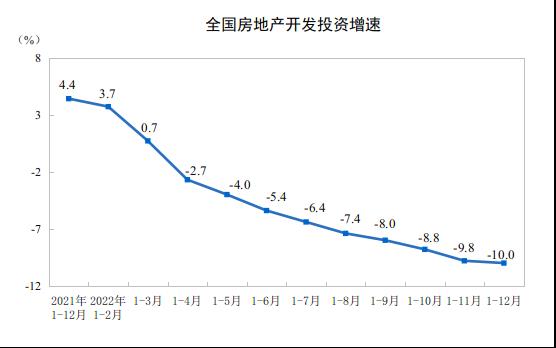

In 2022, the national real estate development investment decreased by 10.0%.

I. Completion of investment in real estate development

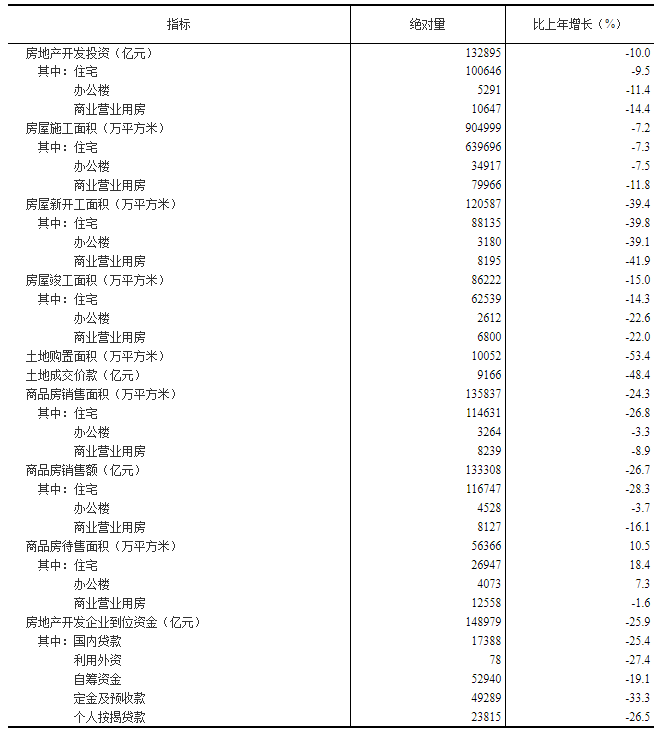

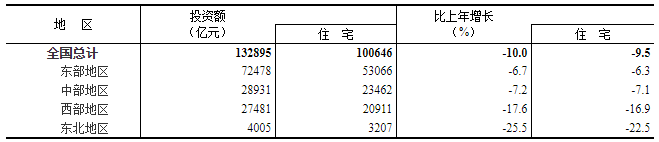

In 2022, the national real estate development investment was 13,289.5 billion yuan, down 10.0% from the previous year; Among them, residential investment was 10,064.6 billion yuan, down 9.5%.

In 2022, the housing construction area of real estate development enterprises was 9,049.99 million square meters, down 7.2% from the previous year. Among them, the residential construction area was 6,396.96 million square meters, down by 7.3%. The newly started housing area was 1,205.87 million square meters, down by 39.4%. Among them, the newly started residential area was 881.35 million square meters, down 39.8%. The completed housing area was 862.22 million square meters, down by 15.0%. Among them, the completed residential area was 625.39 million square meters, down by 14.3%.

Second, the sale and sale of commercial housing

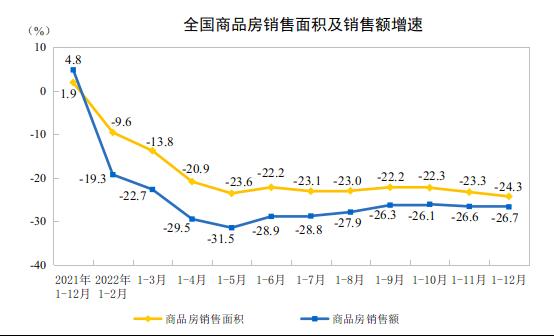

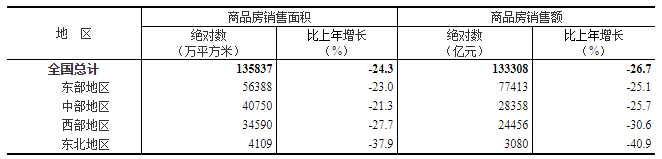

In 2022, the sales area of commercial housing was 1,358.37 million square meters, a decrease of 24.3% over the previous year, of which the sales area of residential housing decreased by 26.8%. The sales of commercial housing was 13,330.8 billion yuan, down by 26.7%, of which residential sales fell by 28.3%.

By the end of 2022, the area of commercial housing for sale was 563.66 million square meters, an increase of 10.5% over the previous year. Among them, the residential area for sale increased by 18.4%.

Three, the real estate development enterprise funds in place

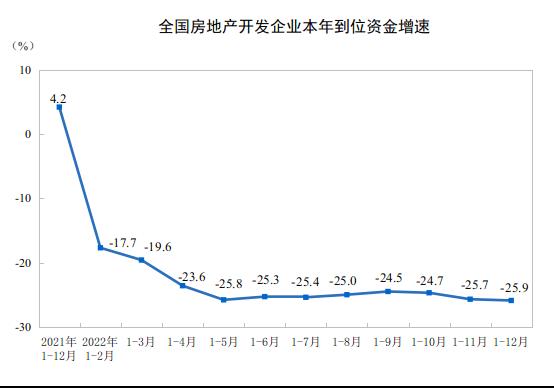

In 2022, real estate development enterprises received 14,897.9 billion yuan, down 25.9% from the previous year. Among them, domestic loans were 1,738.8 billion yuan, down by 25.4%; Foreign capital utilization was 7.8 billion yuan, down by 27.4%; Self-raised funds were 5,294 billion yuan, down by 19.1%; Deposits and advance receipts were 4,928.9 billion yuan, down 33.3%; Personal mortgage loans reached 2,381.5 billion yuan, down 26.5%.

Fourth, the real estate development boom index

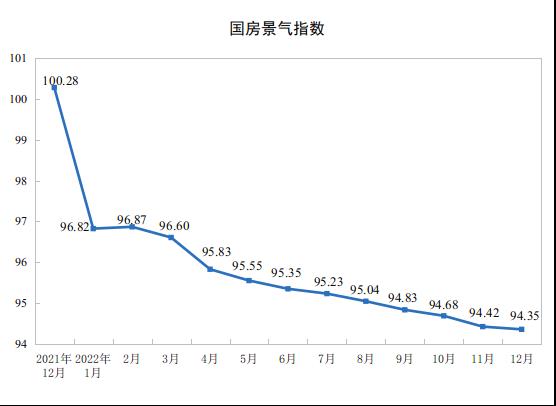

In December 2022, the real estate development boom index (referred to as "national housing boom index") was 94.35.

Table 1 National Real Estate Development and Sales from January to December, 2022

Click to download:Related data table

Table 2 Investment in real estate development in the eastern, central and western regions and northeast regions from January to December, 2022

Table 3 Real estate sales in the eastern, central and western regions and northeast regions from January to December, 2022

annotations

1. Interpretation of indicators

Investment completed by real estate development enterprises this year: refers to all the investment completed during the reporting period for housing construction projects, land development projects, public welfare buildings and land purchase fees. This indicator is cumulative data.

Sales area of commercial housing: refers to the total contracted area of newly-built commercial housing sold during the reporting period (i.e. the construction area confirmed in the formal sales contract signed by both parties). This indicator is cumulative data.

Sales of commercial housing: refers to the total contract price of selling new commercial housing during the reporting period (i.e. the total contract price confirmed in the formal sales contract signed by both parties). This indicator is the same caliber as the sales area of commercial housing, and it is also cumulative data.

Sale area of commercial housing: refers to the construction area of commercial housing that has been completed for sale or lease at the end of the reporting period, but has not been sold or leased, including the housing areas completed in previous years and completed in this period, but excluding the housing areas that have been completed in the reporting period, such as demolition and reconstruction, unified construction and agent construction, public supporting buildings, real estate companies’ own use and revolving houses, which cannot be sold or leased.

Funds paid by real estate development enterprises this year: refers to all kinds of monetary funds and source channels actually used by real estate development enterprises for real estate development during the reporting period. It is subdivided into domestic loans, utilization of foreign capital, self-raised funds, deposits and advance receipts, personal mortgage loans and other funds. This indicator is cumulative data.

Housing construction area: refers to the total housing construction area constructed by real estate development enterprises during the reporting period. Including the area newly started in this period, the area of houses that entered this period in the previous period and continued to be constructed, the area of houses that were suspended in the previous period and resumed construction in this period, the area of houses completed in this period and the area of houses that were suspended after construction in this period. The construction area of multi-storey buildings refers to the sum of the construction areas of each floor.

Newly started housing area: refers to the newly started housing area of real estate development enterprises during the reporting period, with unit projects as the accounting object. It does not include the construction area of houses that started construction in the last period and continued construction in the reporting period, and the construction area that stopped construction in the last period and resumed work in this period. The construction of the house shall be based on the date when the house officially begins to break ground and dig trenches (foundation treatment or permanent piling). The newly started building area refers to the total building area of the whole building and cannot be calculated separately.

Completed building area: refers to the total building area of all buildings that have been completed according to the design requirements, reached the living and use conditions, passed the acceptance inspection or reached the completion acceptance standard, and can be officially handed over for use during the reporting period.

Land purchase area: refers to the land area where real estate development enterprises have obtained land use rights through various means this year.

Land transaction price: refers to the final amount of land use right trading activities of real estate development enterprises. In the primary land market, it refers to the final allocation of land, the "bidding, auction and auction" price and the transfer price; In the secondary market of land, it refers to the final contract price of land transfer, lease and mortgage. The land transaction price is the same as the land purchase area, and the average purchase price of land can be calculated.

2. Statistical scope

All real estate development and operation legal entities with development and operation activities.

3. Investigation methods

Conduct a comprehensive survey on a monthly basis (except January).

4. Brief description of the national real estate development boom index.

The national real estate development boom index (hereinafter referred to as "national housing boom index") follows the theory of economic cycle fluctuation, is based on the boom cycle theory and boom cycle analysis method, uses time series, multivariate statistics and econometric analysis methods, takes real estate development investment as the benchmark index, selects relevant indicators of real estate investment, capital, area and sales, and excludes the influence of seasonal factors, including random factors. It is compiled by the growth rate cycle method, and is compiled monthly according to the newly added data. The national housing boom index chooses 2012 as the base year and sets its growth level at 100. Under normal circumstances, the national housing boom index is 100 points, which is the most suitable boom level, with a moderate boom level between 95 and 105 points, a low boom level below 95 and a high boom level above 105.

5. Division of East, Central, West and Northeast China

The eastern region includes 10 provinces (cities) including Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Hainan; The central region includes six provinces of Shanxi, Anhui, Jiangxi, Henan, Hubei and Hunan. The western region includes 12 provinces (cities and autonomous regions) including Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Ningxia and Xinjiang. Northeast China includes Liaoning, Jilin and Heilongjiang provinces.