Domestic games blow the horn to the sea

In recent years, actively promoting game products to the sea has become a key strategy for the development of many game companies. It is understood that traditional game companies such as FunPlus, IGG and Zhixingtong, whose game products are popular all over the world, have been deeply cultivated overseas for many years, and have rich strategic experience and performed well. For example, IGG’s popular game "Kingdom Era" has won the best-selling list in the App Store in 85 countries and regions for more than two years, and its global revenue has exceeded 825 million US dollars. Not only big manufacturers have the ability to open overseas markets, but also some small domestic manufacturers focus on deepening the segmentation field and occupy a good market share in overseas markets.

Domestic games going to sea is the development trend of the industry.

The effect of game companies going out to sea is gradually emerging. According to the App Annie report, from July 2012 to June 2018, the comprehensive downloads of China mobile games in the App Store outside China exceeded 14 billion times. In the first half of 2018, the comprehensive revenue of iOS and Google Play increased by more than 40% year-on-year; Comprehensive user expenditure exceeds $16 billion; There are more than 4,400 games on APP Store and Google Play in markets outside China, among which nearly 900 games are released by publishers in China whose users spend more than US$ 1 million.

Compared with literature, film and television, animation and so on, games have more universal entertainment functions, and the cultural differences they need to cross are relatively small. In the past six years, domestic games have been frequently put out to sea, which also reflects the vigorous development of the export market of China’s cultural industry.

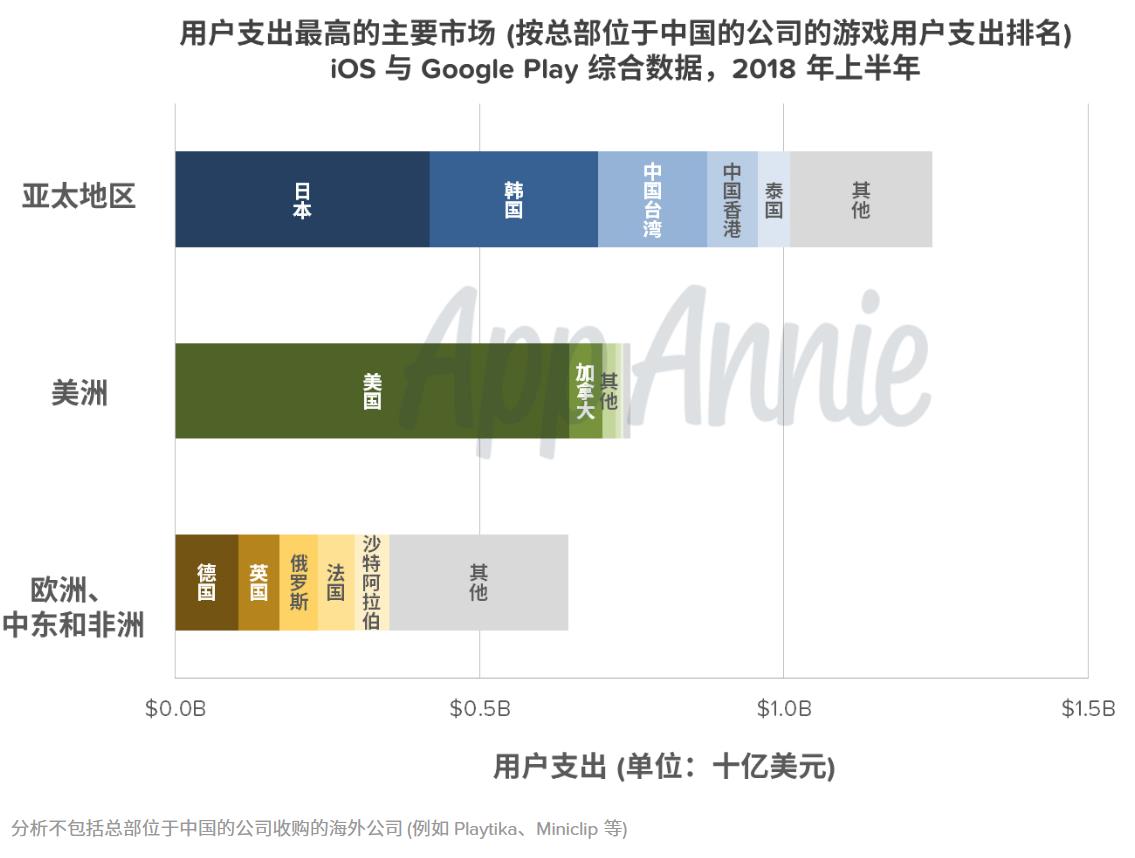

The game is hot in the sea, which is no longer limited to Hong Kong, Macao and Taiwan, Southeast Asia and other areas with similar user attributes, but also expands the mature game market in Europe, America, Japan and South Korea. In fact, the number of overseas high-quality paying users is even larger, and the game grading system is more perfect. Therefore, in order to avoid large-scale domestic games and strong competition, many game manufacturers have actively deployed to overseas markets, forming a trend of all-round industrial development.

Global game downloads, user spending and participation continue to rise.

According to App Annie’s data report, from the first half of 2016 to the first half of 2018, the global game download volume of iOS and Google Play increased by 30%, the global game user expenditure increased by 55%, and the global game usage time increased by 30% only for Android phones.

According to the China Game Industry Report from January to June 2018, the overseas sales revenue of online games independently developed by China in the first half of the year was US$ 4.63 billion, a year-on-year increase of 16%. The overseas market has grown nearly 15 times in five years.

The double income of China’s game industry in overseas markets depends on the change of its world status. Since its development for more than 20 years, the game production has been upgraded from "Made in China" as an early supplier to "Created in China" now, from focusing on the rough expansion in quantity to paying more attention to independent innovation, focusing on building the leading edge in brand and technology, and bringing the China brand to the global stage with more international ideas and methods.

In the strategy of going to sea, China has gained full cultural self-confidence in terms of technology accumulation, talent training, capital supply, creative ideas and cultural details, and the gap between it and the global game industry is getting smaller and smaller, even exceeding the average level of global games in some aspects. At the same time, under the environment of "China culture fever", the game went out to sea to show the richness of Chinese culture to users around the world more closely.

China’s game publishers have made outstanding achievements in the Asia-Pacific market.

According to App Annie’s data report, the Asia-Pacific region plays a leading role in the overseas expansion of China’s game publishers. First of all, the game payment mode in overseas countries is very mature, especially the payment base of high-quality users is relatively stable, and this payment habit of players also makes the cash flow of game companies tend to be stable. The average payment rate of Japanese players in the Asia-Pacific region is over 60%, and the average annual cost is $312.97; American users’ payment habits have long been developed, and they can get high income under a certain market accumulation; Russia and the Middle East also have a lot of room for growth.

Secondly, India, the second most populous country in the world, has made great contributions to the overseas downloads of China’s game publishers. Compared with Europe and America, China and South Korea, which have profound game culture, are more likely to accept the export of’s cultural industry, and their own game industry is mature, the rules are transparent, and the per capita consumption level is high, so it is easier to input games with the help of cultural resonance. At the same time, many factors, such as the increase in the export volume of smart phones in China, have helped more mobile game applications to enter overseas markets through pre-installation.

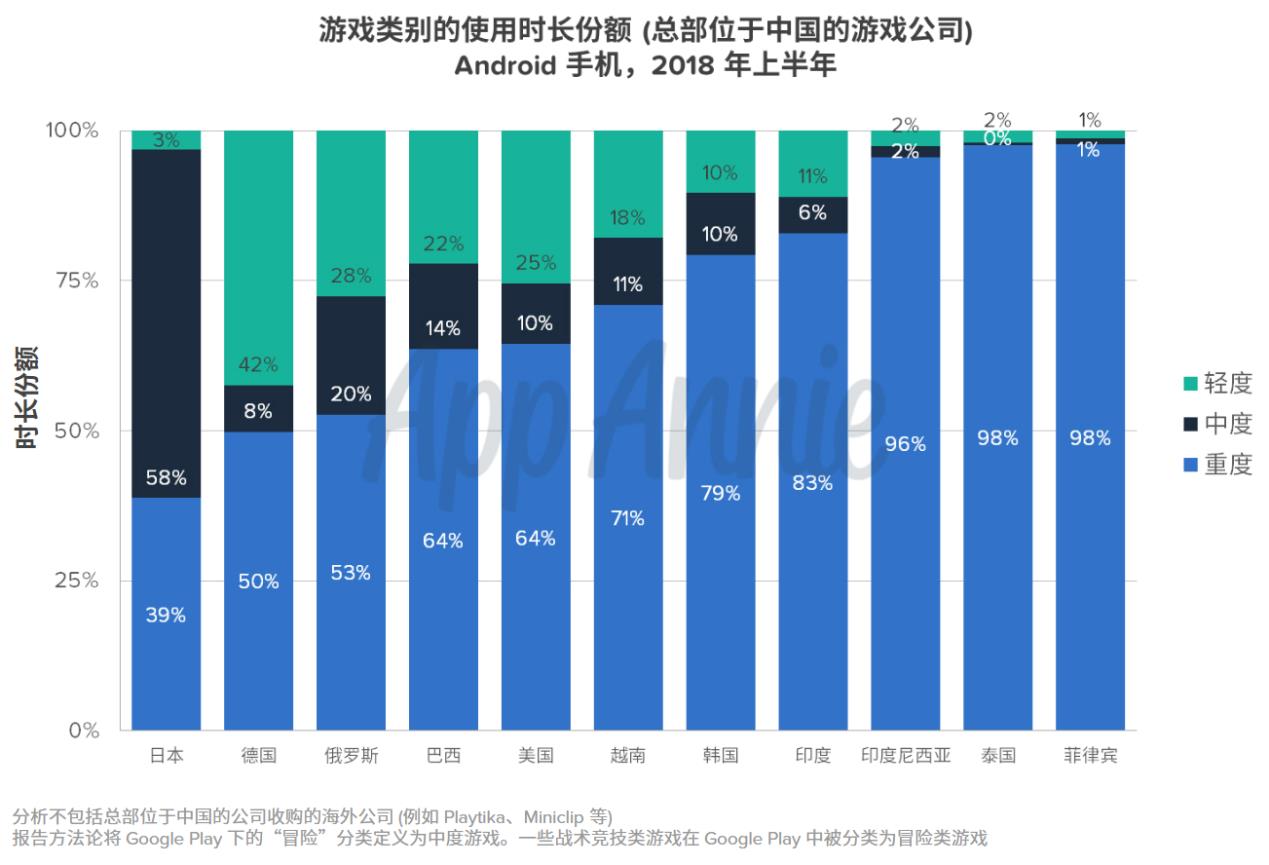

Heavy games lead global game participation.

In the first half of 2018, according to the data of domestic games in the global gamer participation, the data proportion of game categories varies greatly among countries. In some Asia-Pacific regions, such as Thailand and the Philippines, 98% of players prefer to play heavy games, while Indonesia’s players also have as high as 96% participation. The market of light and moderate games is very weak, but only Japan has a 58% share in the field of moderate games, which greatly exceeds that of other countries in the same period.

Looking at the feedback from users in the global market, moderate and heavy games are the main direction for China game manufacturers to push overseas markets. The reasons are as follows: First, compared with the light game playing system, moderate and heavy games are more complicated, and the theme types are more diversified, emphasizing antagonism and sociality among players, and it is easier to obtain user retention rate. Second, light games are easier to use and have wide user coverage, but the player’s viscosity is low. Moderate and heavy game users have deeper content, higher player loyalty and stickiness, and are more likely to form a specific user target group. Third, moderate and heavy game development costs are higher, profitability is stronger, and the life cycle of the market is longer. Therefore, domestic game manufacturers are more willing to invest in medium and heavy game products that can make long-term profits.

It is understood that heavy games are mainly action games, role-playing games and strategy games; Moderate games are mainly arcade games, card games and racing games; Light games are mainly leisure games, educational games and music games.

According to the above data of App Annie, in the first half of 2018, the top four overseas users of domestic games were heavy games. The traditional game companies in China, represented by IGG’s Age of Kingdom, FunPlus’s Age of Firearms, King of Avalon: Battle of the Dragon, and Zhi Xingtong’s Disputes over Kings, have been committed to the global research and development, global market and global operation of games for many years, and accumulated valuable and profound.

The overseas distribution of domestic games has also put forward higher requirements for the game industry itself. Not only need to have super-high technical support, exquisite image quality display, localized intimate service, but also need to have novel creative self-research ability and fine product operation ability. Through the research and analysis of user groups’ big data, it has become the core element of the game market to enhance the comprehensive competitiveness and prolong the game life for product distribution. Domestic games are bound to bear rich fruits in a high-quality and demanding environment. (Reporter Wu Min)