Business War | Huawei Baidu Confronted "Urban Smart Driving"

Last Saturday night,SubordinateThe brand launched a pure electric SUV called "New Lantu FREE". Originally, this was just an ordinary new car replacement, but when the brandAfter the car is released, 25,000 yuan can be added for optional installation.After the news of NOA intelligent driving system, it immediately triggered the industry’s response from L4 level.Attention to the competition of L2+ advanced intelligent driving.

2023 is called "the first year of NOA smart driving in cities", and many institutions are optimistic about the outbreak and popularization of high-level smart driving in the second half of the year. For a long time in the past, only a few car companies, such as Tucki, were pushing the NOA market in the city. Nowadays, Huawei, and other powerful Internet giants have sprung up everywhere, quickly staking out the land with the attitude of "suppliers", successfully binding a number of car companies to realize the mass production of NOA, and making the market competition more and more fierce.

Entering the "L2+" market, Baidu’s "dimensionality reduction" is against Huawei.

The reporter noticed that the "New Lantu FREE", which was launched in mid-August, is the first new car in the mass production of NOA in Baidu City. It is officially called "Baidu Apollo Highway Driving Pro integrated product". Before this, the pace of Huawei’s intelligent driving will be faster. After the release of HUAWEI ADS 2.0 (Huawei’s advanced intelligent driving system), BAIC’s Extreme Fox Alpha S HI version, Changan’s Aouita 11 and Wenjie M5 have landed, and there will be more than ten new cars such as high-end cars cooperating with Chery in the future. According to the information released by Baidu at present, in addition to the blue map of Dongfeng, the planned Jidu car and the extreme cooperation with Geely are still on the road.

In the field of intelligent driving with "NOA in the city" as the symbol, Baidu and Huawei finally have a battle, which has been traced before this year’s Shanghai Auto Show. On the same day of April 16th, Baidu and Huawei held their own smart car business conferences, revealing each other’s progress in NOA and other smart driving technologies. Yifu Chen, an expert on smart driving, pointed out that the smart driving car with Huawei technology is like a catfish, which has inspired the changes and progress of other smart driving systems or solution providers. At the same time, many enterprises are accelerating the shift from L4, which is difficult to make profits, to L2+, which is easier to land, and to the mass production of NOA. The reporter noticed that in the past two years, not only Baidu and Huawei, but also technology companies such as Tencent and Xiaoma Zhixing have re-recognized the future commercial profit model of intelligent driving. After Baidu’s smart car business was adjusted from L4 route to L2 this year, the new car was released in August, which means that Baidu officially opened a confrontation with Huawei at L2+ smart car track.

The industry believes that behind Baidu’s active "dimensionality reduction" is an important decision to realize the realization of autonomous driving technology. According to CIC’s forecast, the scale of China’s autonomous driving market will increase from 2.3 billion yuan to nearly 400 billion yuan from 2019 to 2025, with a compound annual growth rate of 136%. "By 2026, the market penetration rate of L2+ advanced intelligent driving system vehicles equipped with memory parking, high-speed navigation and urban navigation will exceed 15%, and the industry will usher in an intelligent crossing period. By then, the outbreak of the high-end intelligent driving market will trigger a new round of reshuffle in the automobile industry, and the next three years will become a key window period. Whoever can take the lead in providing consumers with a safe and secure intelligent driving experience with a real sense of acquisition may gain the first opportunity in the intelligent competition in the second half. " Chu Ruisong, vice president of Baidu Group and general manager of the smart car business unit, said earlier.

Who can grab more "smart driving" cakes?

In terms of development mode and technical route, Baidu and Huawei have a lot in common. Who has a better chance to grab more cooperation orders? Song Yachen, a technical engineer who once participated in the research and development of autonomous driving in the new forces and now moved to a joint venture car company, said that the white-hot NOA in the city was forced by the general situation, and it was the right choice for Baidu to weaken L4 R&D and concentrate on L2+. However, he pointed out, "Huawei’s autonomous driving team is reported to have reached the scale of 3,000 to 4,000 people, and the manufacturers that cooperate with it are more obedient, which makes Huawei’s dominance high, and the progress of promoting the profitability of NOA mass production in cities will be faster. Relatively speaking, Baidu’s autonomous driving team started late in L2+, and its expansion is not as strong as Huawei’s, so personally, Baidu will not catch up with Huawei in the short term. "

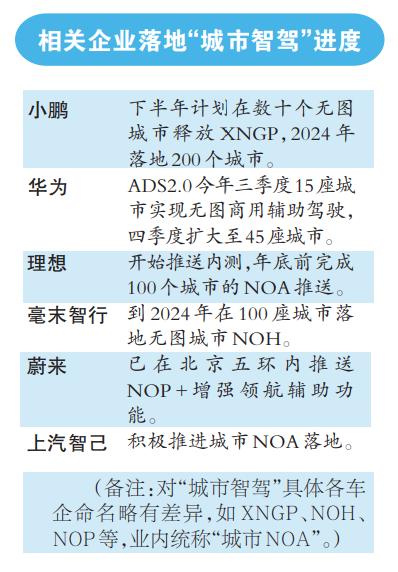

In addition, the big cake of L2+ high-level intelligent driving is welcoming many players, which makes it difficult for Baidu to snatch more car enterprise partners from Huawei. The reporter noticed that in addition to Baidu and Huawei, a number of intelligent driving suppliers have accelerated the implementation of the "parking and parking integration" scheme for NOA functions in cities. This year, Xiaoma Zhixing will mass-produce high-speed and urban parking and parking integrated assisted driving schemes; Youjia Innovation has released a high-level intelligent driving solution supporting high-speed NOA, and will realize NOA function in urban areas through OTA. In terms of mainstream manufacturers, it has also been planned to land NOA functions in related cities this year. For example, Tucki plans to open the city NGP to about 50 cities in the second half of 2023 and land in 200 cities in 2024; Huawei plans to cover the city NCA to 45 cities in the fourth quarter of 2023, ideal andAll push the city NOA internal test. In addition, Internet giants such as Tencent and Ali also have relevant technical reserves, and are involved in the research and development of car companies’ smart driving through different cooperation modes.

Yifu Chen pointed out that in the future, whether Huawei and Baidu can compete for market share in smart driving depends on whether they can win a bigger "sinking market". According to the data of the Passenger Car Association, at present, about 100,000-200,000 vehicles account for more than 50% of the passenger car market in China, which is the car purchase price chosen by most consumers. Insiders pointed out that in order to enter the mid-range car market at this price, enterprises need to cross the three mountains of "cost", "mass production" and "full stack self-research". Judging from the current cooperation lineup, both Huawei and Baidu have chosen the "from high-end to mid-range models" style of play. First, the system will be put to the ground through cooperative car companies with large sales volume, and the recognition of consumers and the market will be sought. The next step is to enter the popularization stage of large-scale mid-range models. According to incomplete statistics, there are 26 intelligent driving suppliers in China who have launched the product scheme of "integrated parking and transportation".

Institutional prediction: L2+ advanced intelligence drives to accelerate industrial reshuffle

Relevant institutions continue to be optimistic about L2+ autopilot landing.issueIt is said that 2023 is the first year of urban NOA, and it is expected that the urban NOA will be released on a large scale in the second half of this year, catalyzing the smart driving market. The analysis also pointed out that the scene of L2+ high-order intelligent driving with "integrated parking and parking" is gradually switching from high speed to cities, and the autonomous driving industry will gradually transition from configuration competition to demand-led. It is reported that NOA, a city that many car companies are striving to build, is known as the last piece of the puzzle of "integrating parking and parking (integrating intelligent auxiliary systems such as memory parking, high-speed navigation and urban navigation)".

The report also pointed out that the continuous introduction of industrial support policies and the batch landing of NOA functions in cities will enhance the available range and user experience of intelligent driving functions, promote consumers to choose advanced NOA configurations, and drive high-computing intelligent driving domain controllers supporting NOA functions in cities, andMarket space has improved. It is recommended to pay attention to the core suppliers of the smart driving industry.

Policy support, high-level wisdom, landing

The reporter noticed that L2+ high-level intelligent assistant system, which has more landing conditions than L4-level automatic driving, is welcoming the policy of landing. Since the beginning of the year, policies related to autonomous driving and consultation documents have been continuously released. On July 26, the countryThe Guide to the Construction of Industry Standard System (Intelligent Networked Vehicle) (2023 Edition) was officially released, which clarified that from the first stage to 2025, the system will form an intelligent networked vehicle standard system that can support the general functions of combined driving assistance and automatic driving. Previously, Xin Guobin, Vice Minister of the Ministry of Industry and Information Technology, said at the the State Council policy briefing held on June 21 that the pilot of intelligent networked car access and road traffic would be launched, and the demonstration application of "car-Lu Yun integration" at the city level would be organized to support the commercial application of conditional autopilot (L3 level) and higher-level autopilot functions.

He also revealed that in 2022, the new car penetration rate of L2-class passenger cars with combined assisted driving function reached 34.5%.

Zhang Kai, Chairman of Millimeter Zhixing, judged that from 2023, intelligent driving products will enter a period of rapid growth, and there will be three trends: "First, urban navigation-assisted driving products will focus on mass production and delivery in 2023. Second, the front-loading market with integrated parking and transportation ushered in the peak of mass production. Third, the commercialization of automatic distribution of terminal logistics forms a closed loop. "